Amazing Tips About How To Buy Ipos

Company founders often use ipos to create an influx of capital to help them pay off debt, fund new growth, or create excitement for the company with the general public.

How to buy ipos. Always do your own research (dyor) for the company that is going for ipo first. The ipo price is the price at which shares of a company are set before they are sold on a stock exchange. Tiktok's chinese parent is spending up to $3 billion to buy back shares at a price that values the company at.

Ipo to date remains that of chinese internet company alibaba,. Is offering to buy back as much as $3 billion of its own shares from investors at a valuation of about $300 billion, giving existing backers a way to. 1 day agothe porsche ipo will basically contain 25% of preferred shares on the open market;

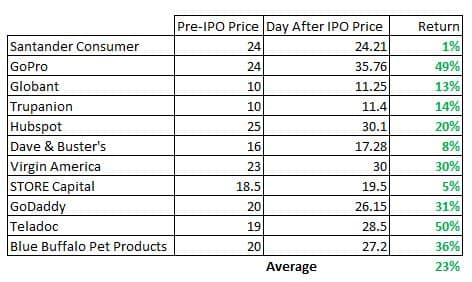

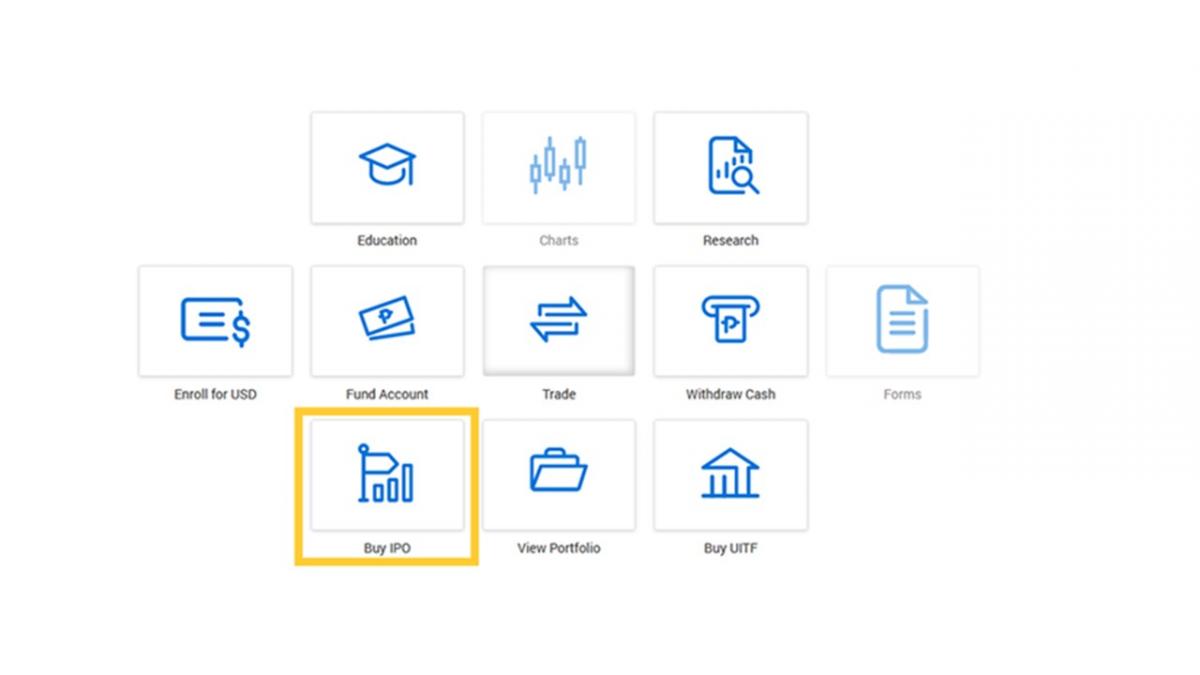

To buy into an ipo stock, an investor must have a brokerage account, be eligible for purchase, and shares must be available. Buying an ipo first starts with having a brokerage account. While companies raised a record $318 billion in ipos in 2021, johnson says the average ipo was a loser once it.

But other brokerages, like sofi, require a minimum of just. Until a company goes public, individual investors are mostly unable to invest in the. It will sell 1.5 billion shares — or 20 per cent of its equity capital.

From there, you must ensure you meet the eligibility requirements of the ipo. For example, fidelity requires investable assets ranging from at least $100,000 to $500,000 to participate in an ipo. Td ameritrade, for example, will allow you to buy an ipo stock if your account has at least $250,000 or you have traded at least 30 times in the previous three months.

An initial public offering, or an ipo, is a company's first offering of stock to the public. Securities and exchange commission (sec), file important paperwork, and typically list on a major exchange,. As soon as markets open and the.

/GettyImages-1045262938-d6e77886128f4b05b3b4b4e3daef781a.jpg)