Inspirating Info About How To Choose Roth Ira

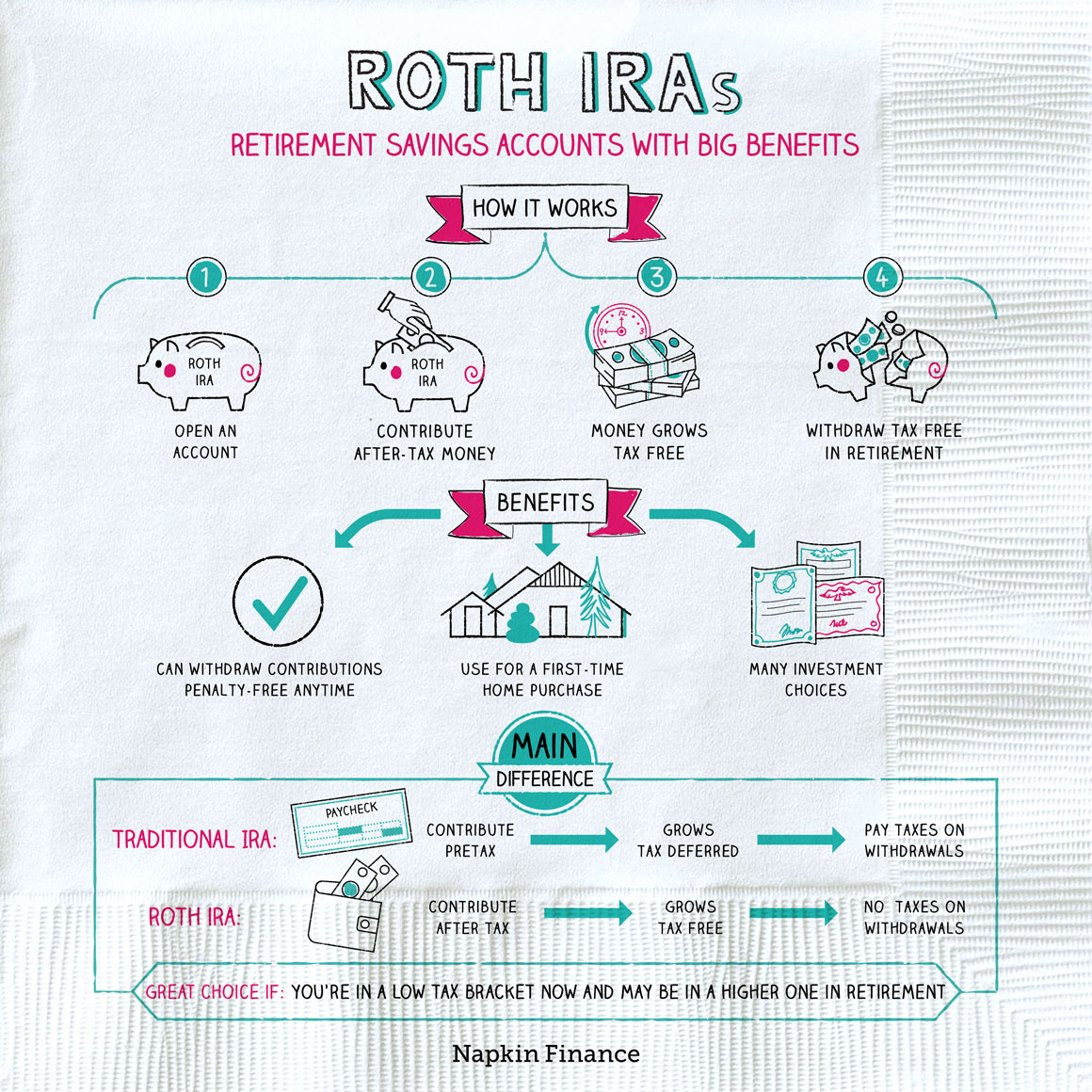

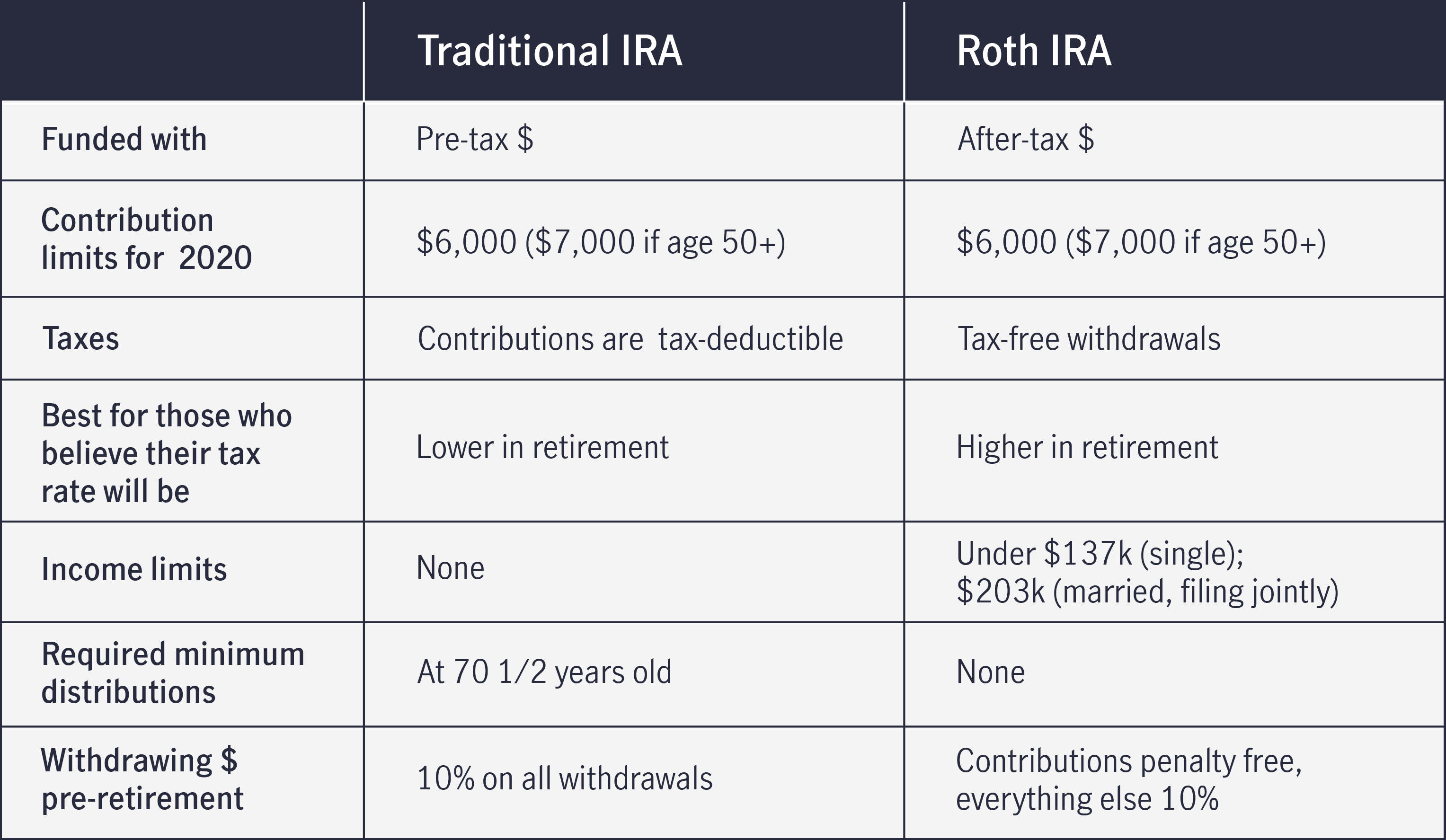

First, you are not taxed on the money you withdraw in retirement.

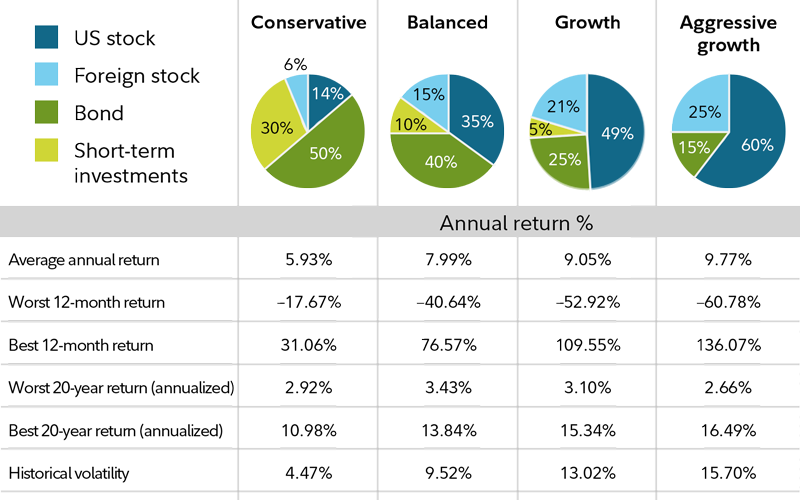

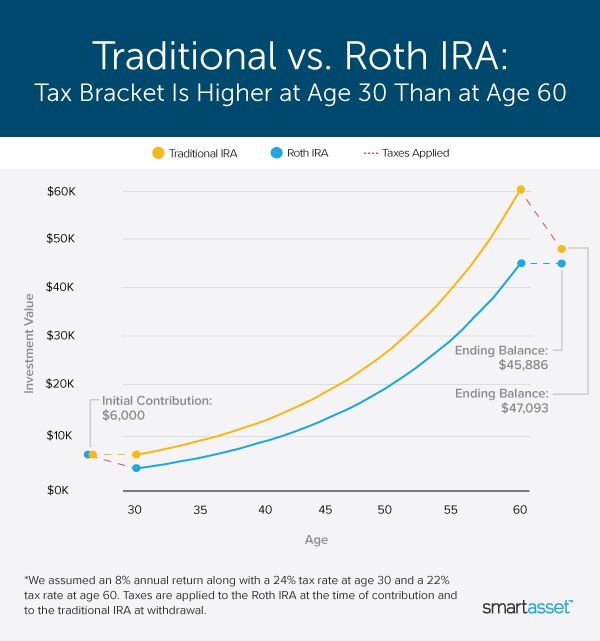

How to choose roth ira. 9 hours agoideally, you can convert enough of your traditional retirement account to a roth in order to minimize the effect of rmds on your tax planning. However, there are a few things to keep in mind when making your decision: Whether that means saving up or investing through a 401 (k) plan and/or roth ira account, investment strategies can change over our lifetime.

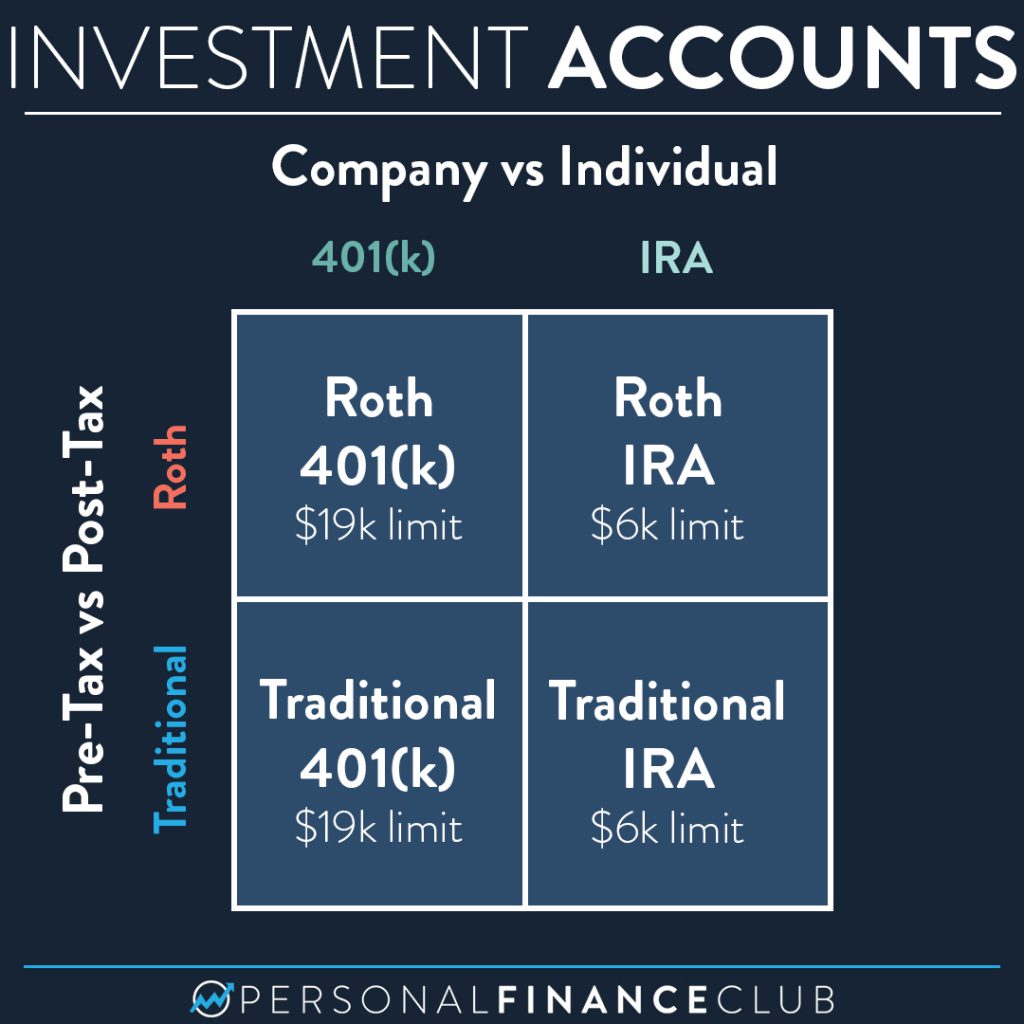

First, you must decide what type of account you want: Ad explore retirement account with tax advantages. The annual cap on 401 (k) contributions is significantly higher than the roth ira limit.

After looking into it for a few months, i realize there’s so many different. Employees can contribute up to $20,500. You can put all kinds of different investments into your roth ira.

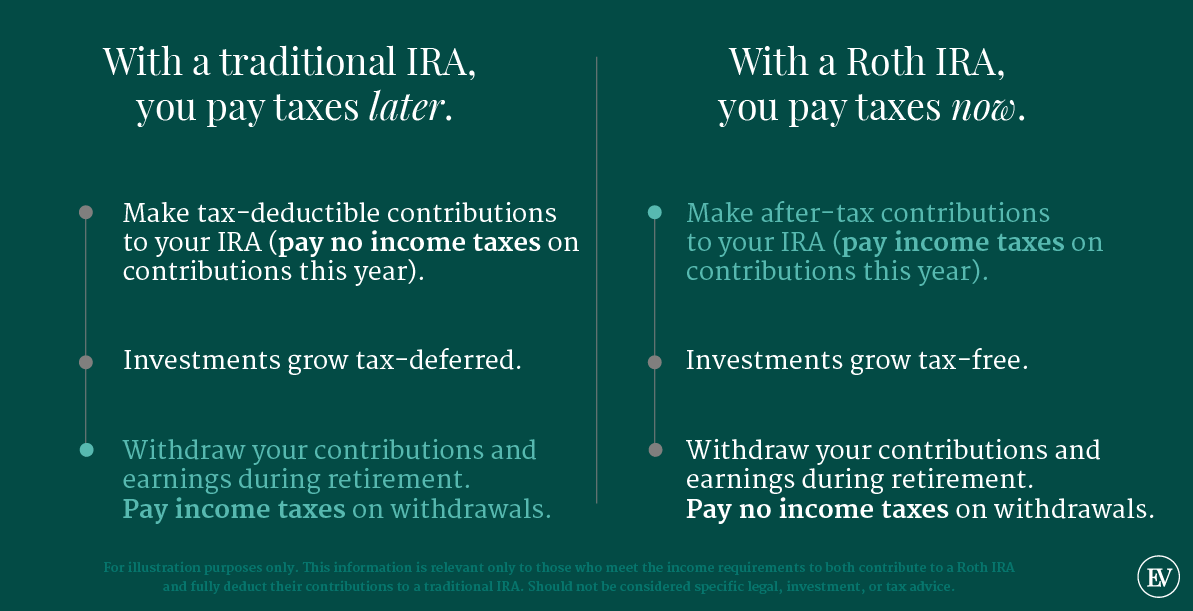

The key difference between the two is when investors pay taxes. You might find one is the best. The first is your current and future income.

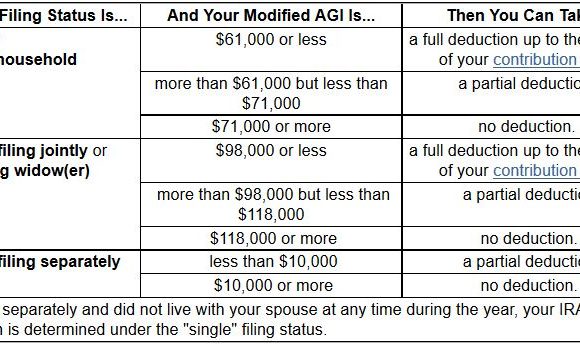

The first step in choosing an ira provider is to decide whether you prefer a traditional ira, in which your savings are invested on a pretax basis, or a roth ira, in which. Employees over 50 can contribute an. This is by far the most.

This can be a big advantage if you are in a similar or. Discover which retirement options align with your financial needs. The best times to make roth.

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)