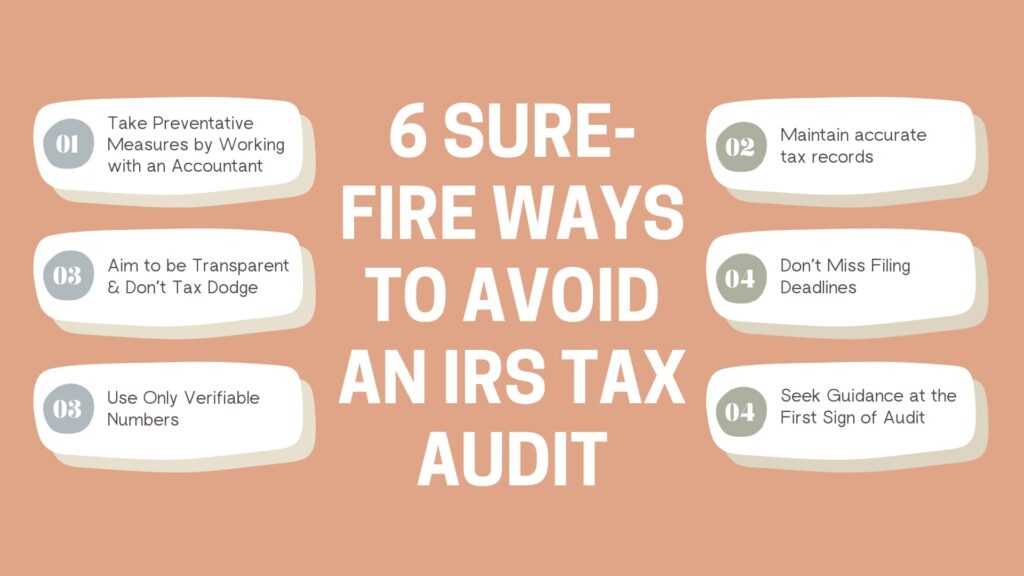

Real Tips About How To Avoid An Irs Audit

How to avoid an irs audit.

How to avoid an irs audit. The only way to reduce risk of an audit is to file a legitimate return and have the proper documentation to back it up, says david gannaway, a former irs agent who is a. Avoiding irs audits in 2022: If you have any questions about tax planning, maximizing deductions, or.

Keep a log and deposit it in the bank. Many taxpayers make mistakes on their returns. 2.3 don’t report large business loss against your w2 income;

Check out these tips to reduce your. Provide more detail when needed. In cases where you've substantially underpaid your taxes, the limit goes up to six years.

1 what is an irs audit? Ad reduce or even legally eliminate irs debt with new settlement prgms. There is no guaranteed way to avoid and irs audit but there are things a taxpayer can do to lower their probability or propensity of being audited:

2.5 don’t take excess deductions or tax credit see more There is no guaranteed way to avoid an irs audit but there are things you can do to lower your probability of being audited. Final thoughts on avoiding irs audits.

If you legitimately earned nothing, file a tax return and report that. 1) be wary of who prepares your tax return most of. 2.4 don’t amend your return, unless you have to;

![Anti-Audit Warfare: How To Avoid Or Beat An Irs Audit [Paperback] Daily, 9781540747181 | Ebay](https://i.ebayimg.com/images/g/be8AAOSw67tiSJqO/s-l500.jpg)