Who Else Wants Tips About How To Get A Federal Tax Id Number

Select your entity type to apply for a federal tax id today sole proprietor / individual.

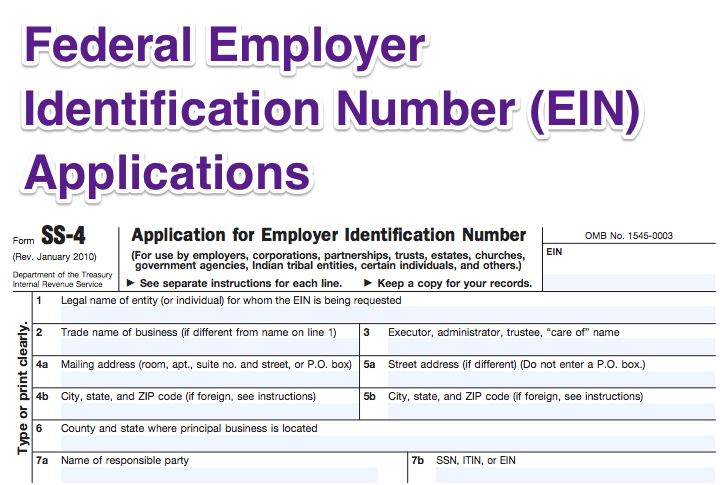

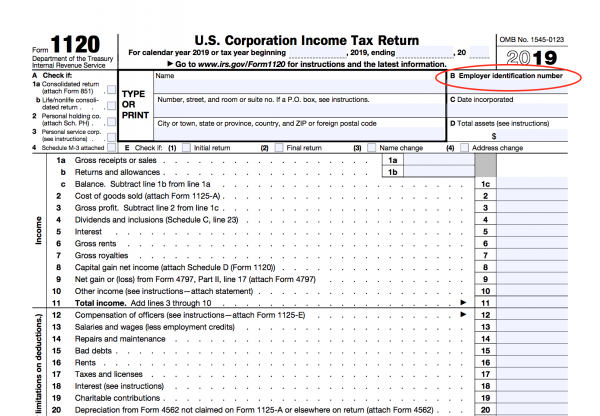

How to get a federal tax id number. How to apply for an ein. In the event that someone dies and leaves behind money, property, or other assets, the administrator, or executor of the estate, will need to obtain what is known as an employer. Loginask is here to help you access how to apply for federal tax id quickly and handle each specific case you encounter.

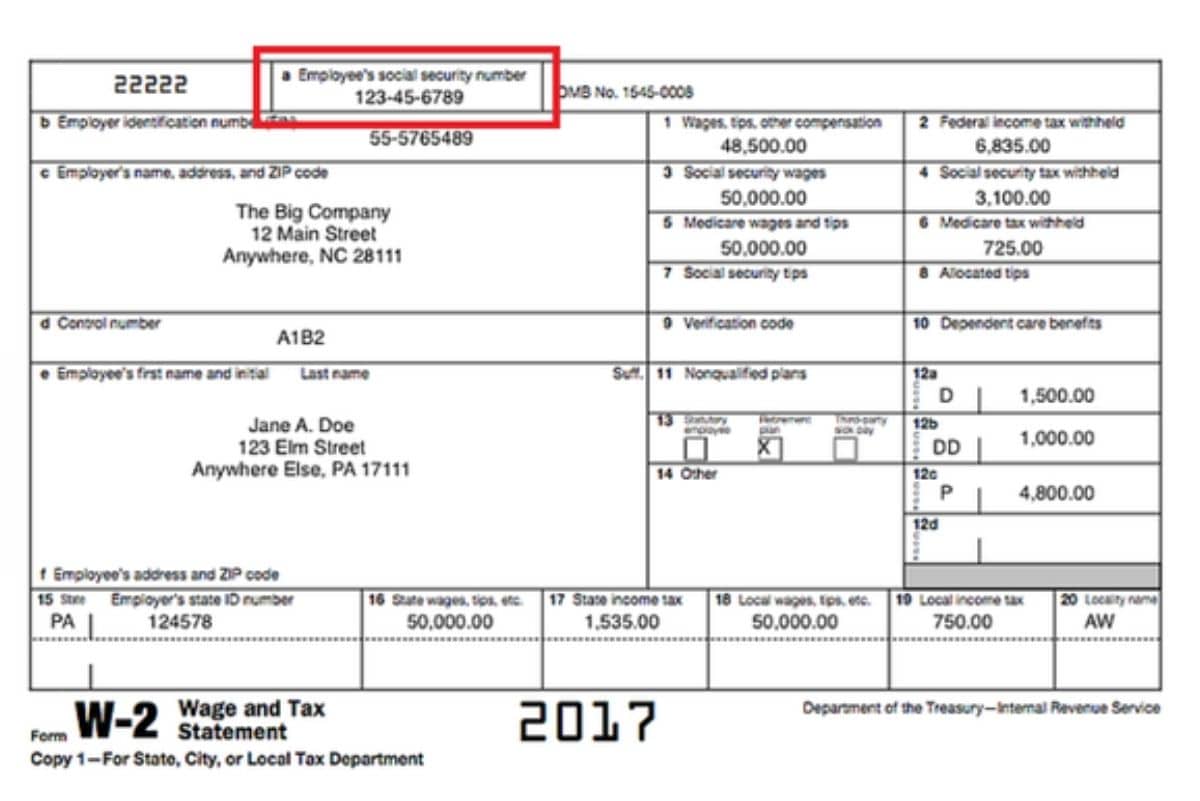

After you have submitted and verified your form, you will receive your federal tax id number in a secure email. As the withholding agent, you must generally request that the payee provide you with its u.s. You must include the payee's tin on forms,.

You may apply for an ein online if your principal business is located in the united states or u.s. Yes, llc’s need a tax id for: Yes, estates are required to obtain a tax id:

Your federal tax id or ein will. Generally, businesses need an ein. If you’re considering a trust to manage your assets, don’t wait to obtain a federal tax id number.

The internet ein application is the preferred method for customers to apply for and obtain an ein. The person applying online must have a valid. Make sure to include your ein with.

It can take anywhere form 30 to 45 days to receive your copy. Once the application is completed,. Every limited liability company with employees is required to get a tax id.

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)